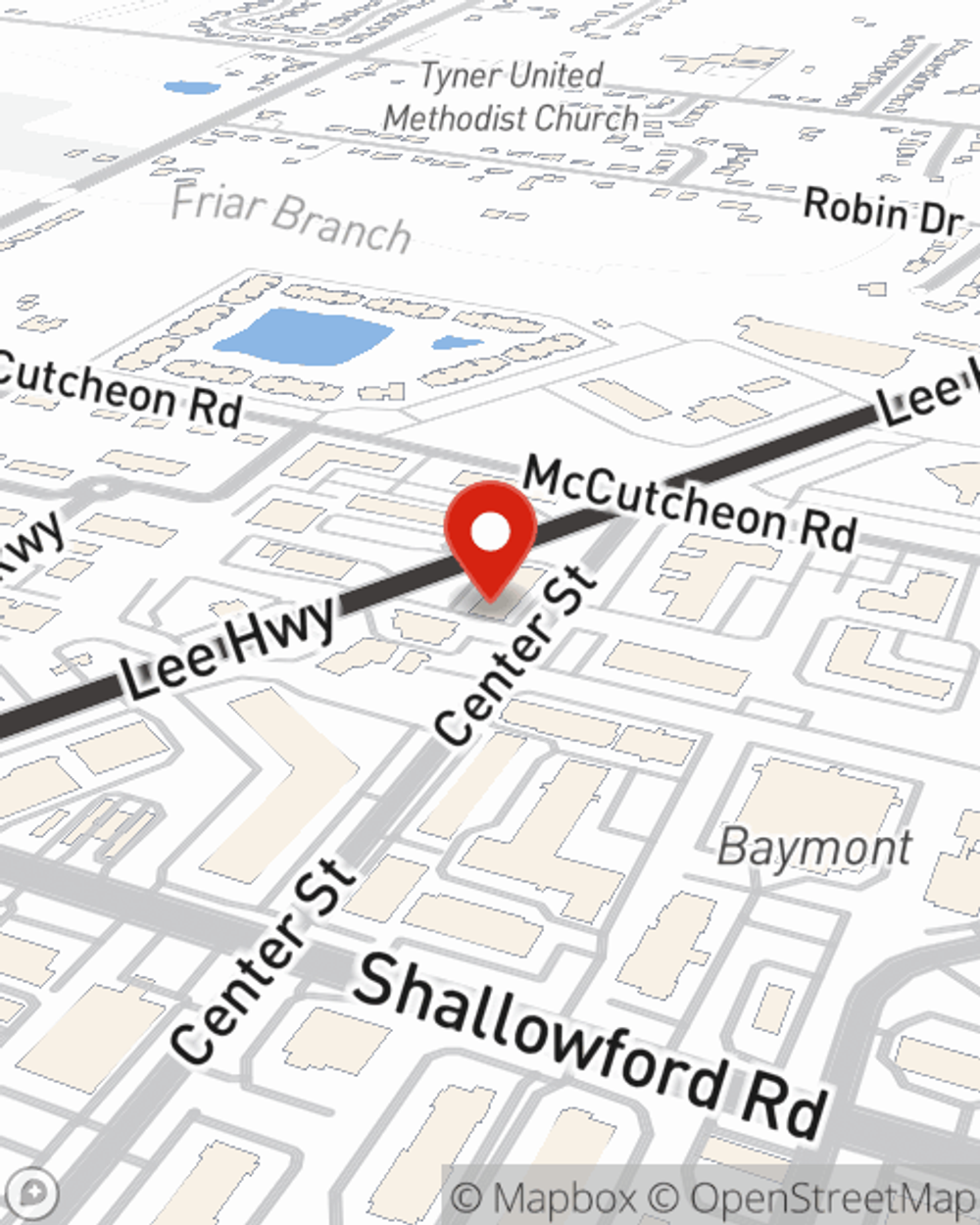

Business Insurance in and around Chattanooga

Looking for small business insurance coverage?

Cover all the bases for your small business

- East Brainerd

- Ooltewah

- East Ridge

- Ringgold

- Ft. Oglethorpe

- North Chattanooga

- Hixson

- Signal Mountain

- Lookout Mountain

- Hamilton County

- Bradley County

- Catoosa County

- Walker County

- Harrison

- Red Bank

- Downtown Chattanooga

- St. Elmo

- Soddy Daisy

Cost Effective Insurance For Your Business.

Worries are unavoidable when you own a small business. You want to make sure your business and everyone connected to it are covered in the event of some unexpected loss or accident. And you also want to care for any staff and customers who stumble and fall on your property.

Looking for small business insurance coverage?

Cover all the bases for your small business

Surprisingly Great Insurance

Being a business owner requires plenty of planning. Since even your most detailed plans can't predict global catastrophes or product availability. In business, you can be certain of one thing: nothing is certain. That’s why it makes good sense to plan for uncertainty with a State Farm small business policy. Business insurance is necessary for many reasons. It protects your hard work with coverage like errors and omissions liability and a surety or fidelity bond. Fantastic coverage like this is why Chattanooga business owners choose State Farm insurance. State Farm agent Geoff Rodgers can help design a policy for the level of coverage you have in mind. If troubles find you, Geoff Rodgers can be there to help you file your claim and help your business life go right again.

So, take the responsible next step for your business and visit with State Farm agent Geoff Rodgers to identify your small business insurance options!

Simple Insights®

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Geoff Rodgers

State Farm® Insurance AgentSimple Insights®

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.